You started a family a few years ago, you’ve been working hard as a professional to pay the bills and sustain a good family life. However, you’ve had a long-held passion to start your business but haven’t been able to get around to it. You are either too busy or have trouble setting up adequate capital for your business. You may also need to shift your mindset from that of an employee to a leader.

Various factors contribute to establishing a successful business. But everything takes time, and delays are inevitable when you have other responsibilities. You must remember that starting a business is not impossible. It requires your commitment, intelligent strategising, and support from your family while you work towards becoming a successful business owner.

Starting a business while juggling a full-time job and family life can be a daunting task. However, with careful planning and strategic execution, it’s entirely possible to build a successful venture. In this blog, we’re providing you with a guide on how to navigate this path.

How To Build Capital While You Are Employed And Are Starting A Family

Remember that as you dream of big ambitions, you shouldn’t ignore your current responsibilities. At the same time, do not underestimate your potential to achieve your goals.

Financial planning and budgeting

- Create a detailed budget: Outline your startup costs, living expenses, and potential revenue streams.

- Emergency fund: Build a financial cushion to cover unexpected expenses.

- Debt management: If necessary, consolidate or refinance high-interest debt to reduce monthly payments.

- Tax implications: Consult with a tax advisor to understand the tax implications of starting a business while employed.

Leveraging your network and resources

- Informative conversations: Network with entrepreneurs, investors, and industry experts to gain valuable insights.

- Mentorship: Seek guidance from experienced mentors who can offer advice and support.

- Leverage your job: Explore opportunities to utilise your professional skills and connections to benefit your startup.

Bootstrapping and self-funding

- Savings and investments: Contribute as best you can, consistently, from your savings and investments.

- Side hustles: Consider taking on additional freelance or consulting work to generate extra income.

- Family and friends: If appropriate, explore the possibility of raising funds from family and friends.

Crowdfunding and online platforms

- Choose the right platform: Research crowdfunding platforms that align with your startup’s goals and target audience.

- Create a compelling campaign: Develop a persuasive campaign to attract potential investors.

- Build a community: Engage with your backers and foster a sense of community around your startup.

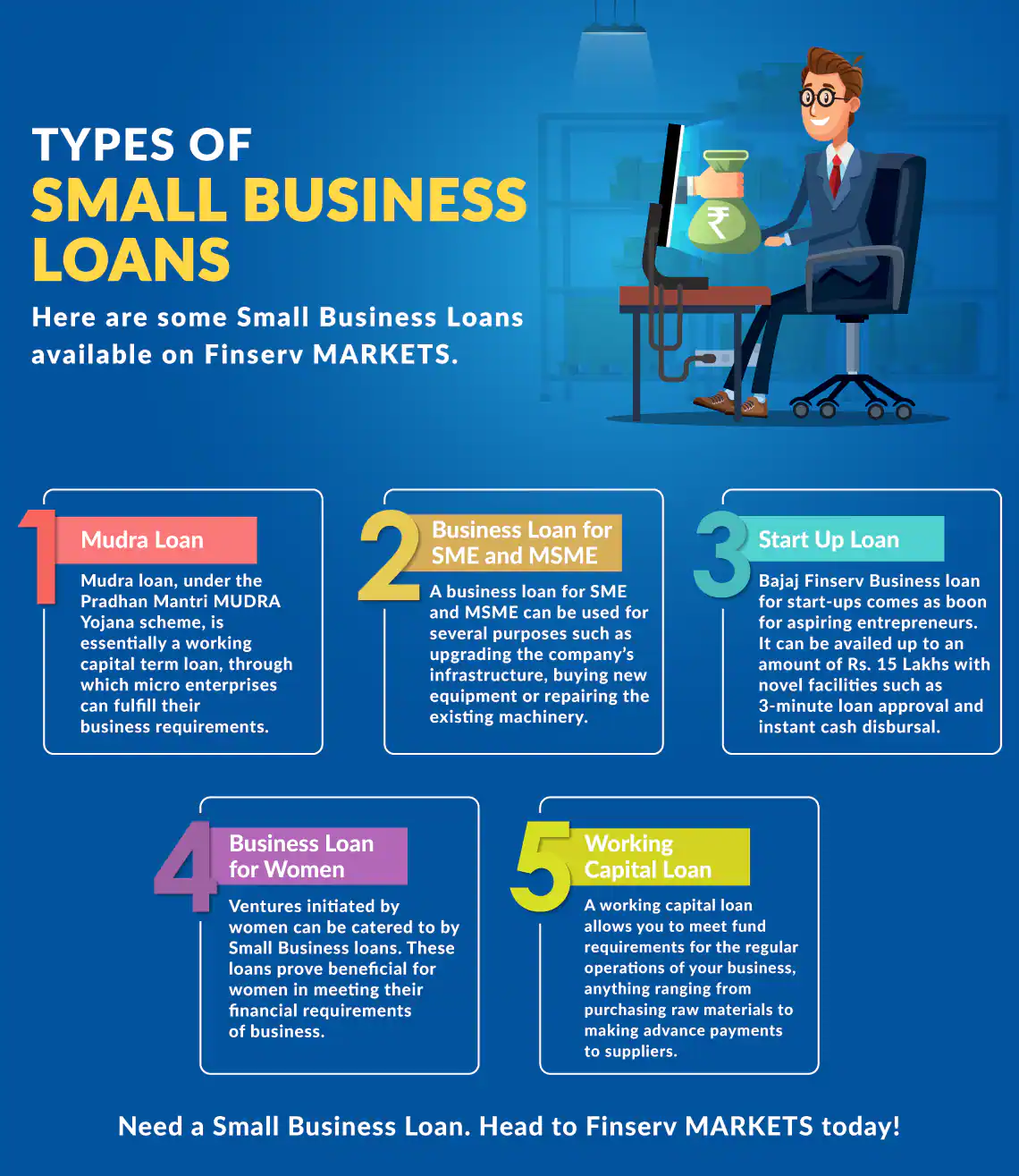

Seeking grants and loans

- Government grants: Explore government grants and programs that support small businesses and entrepreneurs.

- Small business loans: Consider applying for loans from banks, credit unions, or online lenders.

- Angel investors: Network with angel investors who are interested in investing in early-stage startups.

Prioritising time management and productivity

- Time blocking: Allocate specific time slots for your startup, family, and personal life.

- Delegation: Learn to delegate tasks whenever possible to free up your time.

- Productivity tools: Utilise productivity apps and tools to stay organised and efficient.

Building a strong foundation

- MVP development: Focus on building a Minimum Viable Product (MVP) to test your concept and gather feedback.

- Customer acquisition: Develop a strategy to acquire your target customers and build a loyal base.

- Scalability: Design your business model with scalability in mind to accommodate future growth.

Remember, starting a business while balancing work and family life requires dedication, perseverance, and effective time management. By carefully planning and executing your strategies, you can successfully build a thriving venture while maintaining a healthy work-life balance.